by Peter Wilson

You may have seen last week’s article in the Wall Street Journal on the national 4-year college enrollment decline. At PTLA, we have expected to see this national decline, which started a few years ago, given that the largest cohort of college-aged individuals in history (millennials) has gone to college and graduated.

Reading that article, you may think – why invest in student housing? It’s important to remember that a national decline doesn’t mean every college has declined. In fact, we expect to see enrollment growth in many 4-year colleges.

Over the last several years, we have focused on investing in four student housing markets. Our team spent several years researching student housing markets and identified the schools we believe will grow in spite of national trends and get a greater share of the available students.

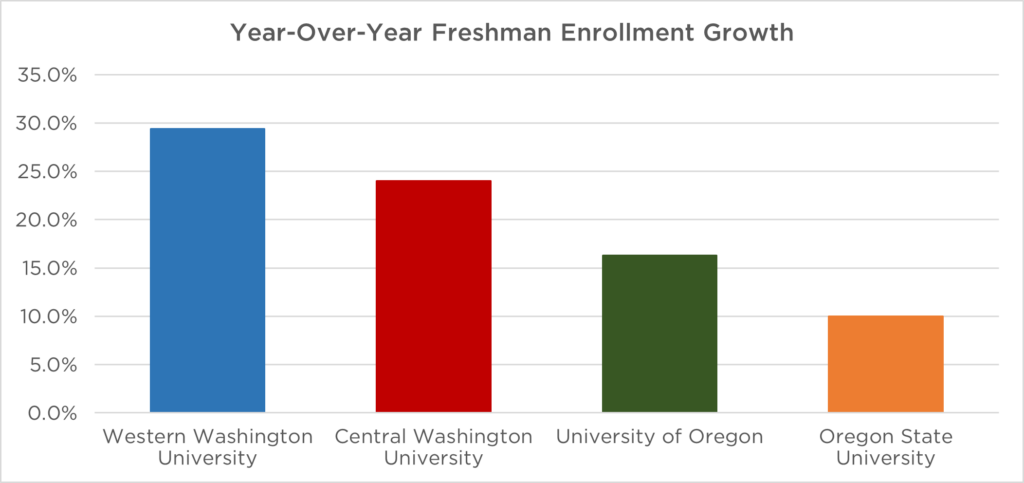

Here’s how those schools performed this year in freshman enrollment:

As you can see in the graph, the schools we targeted saw growing and, in some cases, record freshmen enrollment for Fall 2022. We look at freshman enrollment as an indicator of the future health of total enrollment, based on each school’s student retention history and efforts.

We expect to see further declines in national enrollment in the future, but we are seeing positive trends in the markets in which we have invested or targeted for future investment. Our strategy is to select specific markets for investment and rapidly scale within them. This strategy allows us to have an intimate knowledge of the schools’ historical and projected performance and to build strong operations teams that manage properties at high efficiency. We enjoy and will continue selectively investing in student housing where we see opportunity.